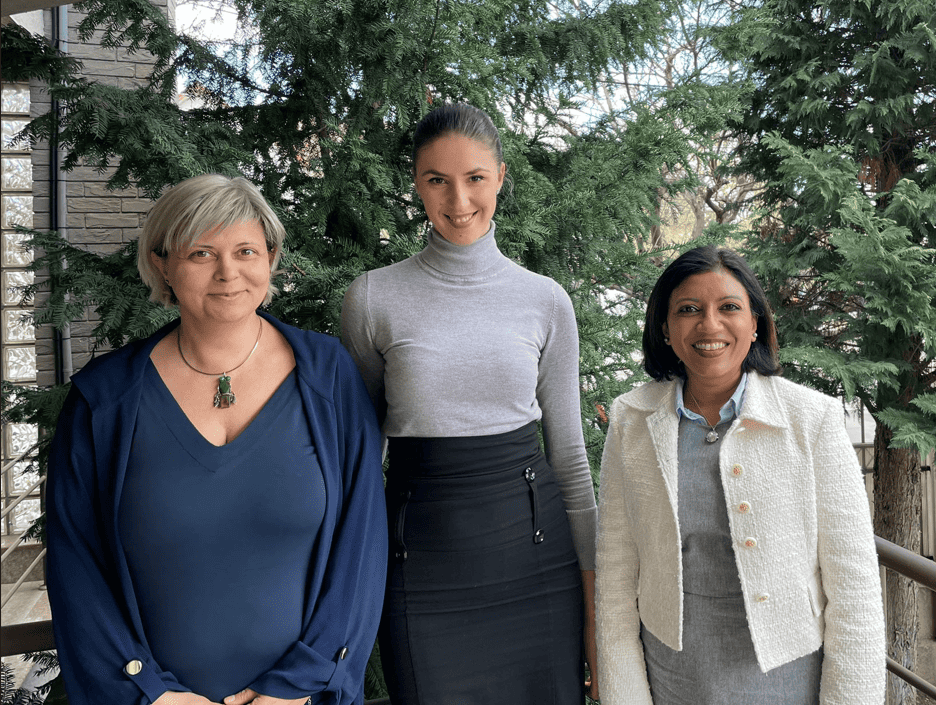

Timely Finance Improves the Romanian Tax Experience

In 2010, Andrea adopted the Romanian term “de ce” to define her woman-owned tax administration service, called “DC Tax”. Translated as “why” in English, “de ce” represents Andrea’s tax services approach, which aims to alleviate the pressures of tax obligations for her clients by providing expert advisory support. Her belief in promoting an understanding of why clients must pay tax demonstrates her years of extensive experience navigating the industry. DC Tax advises businesses on their requirements for remaining compliant with Romanian tax legislation. Through its consulting services for small businesses, the firm seeks to mitigate the impact of Romanian tax administration pressure, which, in recent years, has affected both credit institutions and SMEs alike.[1]

“We are not focused on tax planning — we are focusing on tax compliance and understanding why it’s better to pay [tax] instead of not paying and then assuming a lot of other risks [later on],“ Andrea shares. As the founder of DC Tax, Andrea is part of a small team of consultants and compliance members servicing 45 clients, covering approximately 300 invoices.

Changes in tax law have divided public opinion in Romania after measures for new tax codes were implemented to support the financial sustainability of the country.[2] The nation’s entrepreneurs and SMEs have typically been affected by the new legislation the most. “In March [2022], when they announced the new law, they classified it as tax evasion if you don’t pay the salary, dividend or withholding-related tax within 60 days. If for any reason you’re found with any amount unpaid, settlement procedures with interest are put into place,” Andrea remarked, describing the provisions within the new Romanian tax measures.

Andrea’s enthusiasm for empowering clients to understand this legislation and mitigate tax risks did not come without vulnerabilities for her own business. “Before contacting AGC’s partner, I was sending out invoices [to clients] expecting the payment, but nothing would happen,” Andrea explains. As a woman-led business, she encountered many challenges with ensuring a consistent cash flow, compounded by difficulties related to client payment terms. Initially, she would dispatch invoices with the expectation of prompt payments. Yet, her efforts were often met with delays from clients, leaving her in a difficult position, vulnerable to the country’s profit tax deadlines and creating cashflow constraints.[3]

“This is why I have my accounting services. It’s for very small companies,” Andrea explains. This paradox highlights a cycle where small businesses are susceptible to the fines and penalties imposed by the country’s tax system. Yet, Andrea finds her own business vulnerable to the same penalties due to delays in client payments. She points out how this environment has given rise to a market of tax consultants with varying levels of technical knowledge regarding tax law, ultimately resulting in small businesses paying more for tax compliance efforts, contributing to the system of challenges in the overall landscape.

With the help of AGC’s local partner in Romania and their easy and transparent service, the strain imposed on DC Tax has been alleviated. Because of AGC’s facility, Andrea has saved time by submitting the invoices she would like to have financed without waiting for clients to meet their payment deadline. “Now the process is smooth. I send them [AGC’s partner] the invoices for approval, and they approve them. Factoring empowers me as well,” she adds. Andrea now uses factoring as an opportunity to leverage her business model by building it into the cost of sales, giving her more certainty overall.

AGC acknowledges the importance of securing reliable funding for SMEs, especially those owned by women in emerging markets. Andrea’s story sheds light on our mission of providing fair access to working capital and demonstrates the proactive approach many SMEs take to overcome obstacles and sustain their business growth.

Now the process is smooth. I send them [AGC’s partner] the invoices for approval, and they approve them. Factoring empowers me as well.

– Andrea.

[1] Economedia.ro. BREAKING Draft de ordonanță privind noile măsuri fiscale de acoperit găurile. Accessed March 19, 2024. https://economedia.ro/breaking-draft-de-ordonanta-privind-noile-masuri-fiscale-de-acoperit-gaurile-bugetare-impozit-de-3-pentru-microintreprinderi-cu-venituri-de-peste-300-000-de-lei-impozit-pe-detinerea-mai-multor-propr.html

[2] International Tax Review. Romania introduces a minimum tax on turnover. Accessed March 19, 2024. https://www.internationaltaxreview.com/article/2cg4fex5yhyg8ep6if4sg/sponsored/romania-introduces-a-minimum-tax-on-turnover

[3] KPMG. Taxation of international executives: Romania. Accessed March 19, 2024. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/01/TIES-Romania.pdf

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10