Financial ‘First Aid’ for a Small Growing Business in Serbia

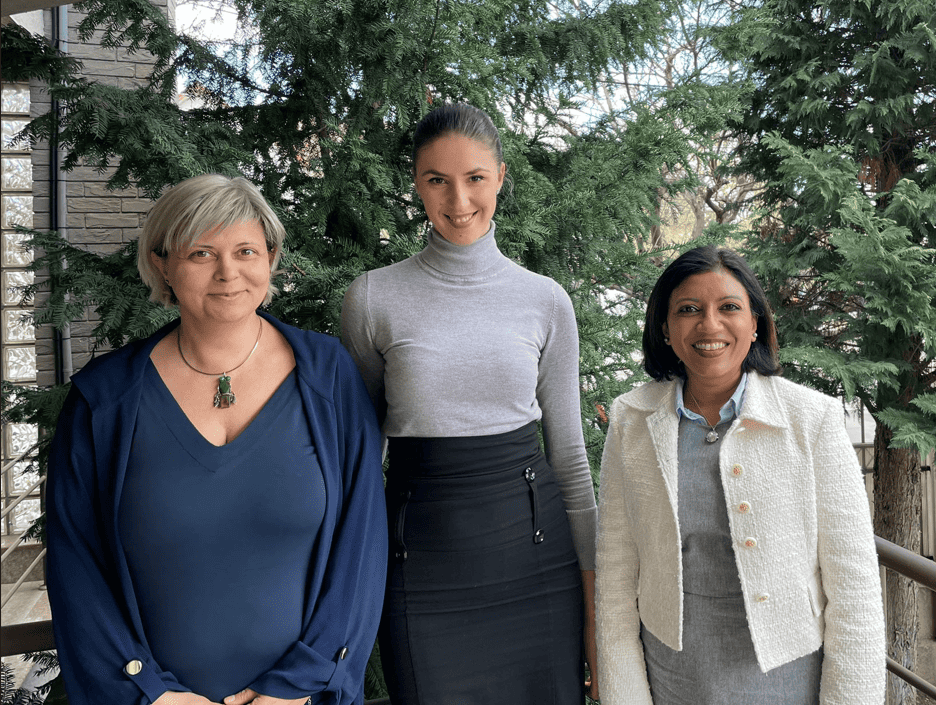

At the first Forum for Development of Female Entrepreneurship in Serbia everyone agreed that women offer great potential to launch small and medium-sized businesses (SMEs), create new jobs and play a larger role in the economy.¹ Jelena Roncevic-Bucher, founder of Project Pharmacy, is a case in point. Established in 2011, Jelena owns 100% of the business and all key management positions are held by women. The company had a strong start. In its first year of operations, Project Pharmacy won a contract to produce sanitary medical fabrics with Mitek, a leading producer of technical fabrics and ready-to-wear garments in Serbia.

Limited Access to Capital Reduces Business Potential

With one strong customer in hand, Project Pharmacy could shift its focus to developing a deep, robust product offering and strengthening its team. In addition to continuous investment in training her team, Jelena’s top priorities were developing her own brands of pharmaceutical products to capture higher margins and investing in production technology to maintain quality standards. Despite strong business prospects, due to strict regulatory requirements, Project Pharmacy found itself with limited access to traditional sources of funding, such as short-term bank loans. All SMEs face barriers to entry, but the situation is even more difficult for women-owned businesses: The World Bank estimates that in 155 out of 173 economies, at least one gender-based legal restriction exists on women’s employment and entrepreneurship.² It is also telling that currently, less than 20% of International Financial Corporation loans are issued to women-owned SME clients, despite evidence that they perform just as well as those owned by men.²

Breaking Down Barriers to Growth

Factoring has proven to be an affordable and reliable source of cash flow that helps women-owned SMEs overcome some of those gender-based barriers. Jelena was able to convert her receivables into cash by securing a factoring facility from AGC’s local factor partner in Belgrade. With this facility, Project Pharmacy can request payment on its confirmed invoices before the invoice due date. The factor sends money to Project Pharmacy immediately and collects full payment from Jelena’s customer when the invoice is due. This arrangement enables the company to maintain uninterrupted purchasing and production and has reduced the number of days between when they invoice customers and when they receive payment by 20% (from 72 to 58 days). It has also reduced the cash conversion cycle from 77 to 62 days. Jelena and her team continue to forge ahead. More women are being hired and her business is growing. She has developed regional partnerships in Bosnia, Herzegovina and Romania, and continues to expand the volume of business with healthcare institutions in Serbia. Project Pharmacy has continued to strengthen brand awareness for its products and has also been giving back to its community by sponsoring a local female volleyball club. Invoice discounting and factoring for SMEs like Project Pharmacy is helping women entrepreneurs secure their rightful place as “Engines of Growth” in economies around the world.

1 ”Share of Women Entrepreneurs in Serbian Economy Small,” InSerbia Today, www.inserbia.info (March 31, 2015)

2 “Women entrepreneurs can drive economic growth,” UN Women Deputy Executive Director Lakshmi Puri, SHE·ERA: 2017 Global Conference on Women and Entrepreneurship, (July 17, 2017), www.unwomen.org

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10