Factoring Comes to Kosovo Small Businesses

Hadie Ahmeti, a poultry farmer in Kosovo, has trouble keeping up with the demand for her product. She raises an exotic breed of quail whose eggs help fight hypertension. Her small family farm supplies Perdix eggs and birds locally and throughout Europe to Interex supermarkets (an affiliate of the global French retailer Intermarché).

Customers would buy more of her eggs if she could meet the demand. But waiting months for payment on her invoices ties up the capital she could invest in growth. Help is on the way. In March, Advance Global Capital ltd. launched AGC Faktor–the first licensed non-bank financial institution in Kosovo–to provide short-term financing for small and medium-sized enterprises (SMEs) via invoice finance.

Obstacles to Growth

Mrs. Ahmet is not alone in confronting obstacles to growing her business. Inadequate financing, poor governance, and inadequate economic development stifle many legitimate businesses. With jobs hard to come by, Kosovo’s citizens rank among Europe’s poorest. Tens of thousands of Kosovans have left their young country in search of work in more prosperous states within the EU. Coverage by The Economist, Financial Times and other major publications paint a bleak picture, but change is possible.

Unlocking the Value of Invoices

The development of financial ecosystems that serve SMEs can lead to more inclusive employment growth, increased wages and a range of other positive outcomes. Investing in SMEs–particularly women-owned businesses – stimulates economic growth and social stability. Citizens with jobs and a sense of opportunity are more likely to stay in Kosovo and build a future there.

Supply chain finance unlocks the potential of a valuable asset all SMEs hold—their invoices. In supply chain finance, a third party or factor advances short-term funding to suppliers that sell goods and services. The factor either purchases outstanding invoices, or they accept them as collateral. Small companies like Miniferma Fëllënza, Mrs. Ahmet’s company, gain access to working-capital based on the reliability of their corporate customers (Interex, in this case) rather than the strength of their own balance sheets. Instead of waiting up to 90 days for an invoice to come due, Mrs. Ahmet gets paid by AGC Faktor shortly after making her delivery.

A Network for Success

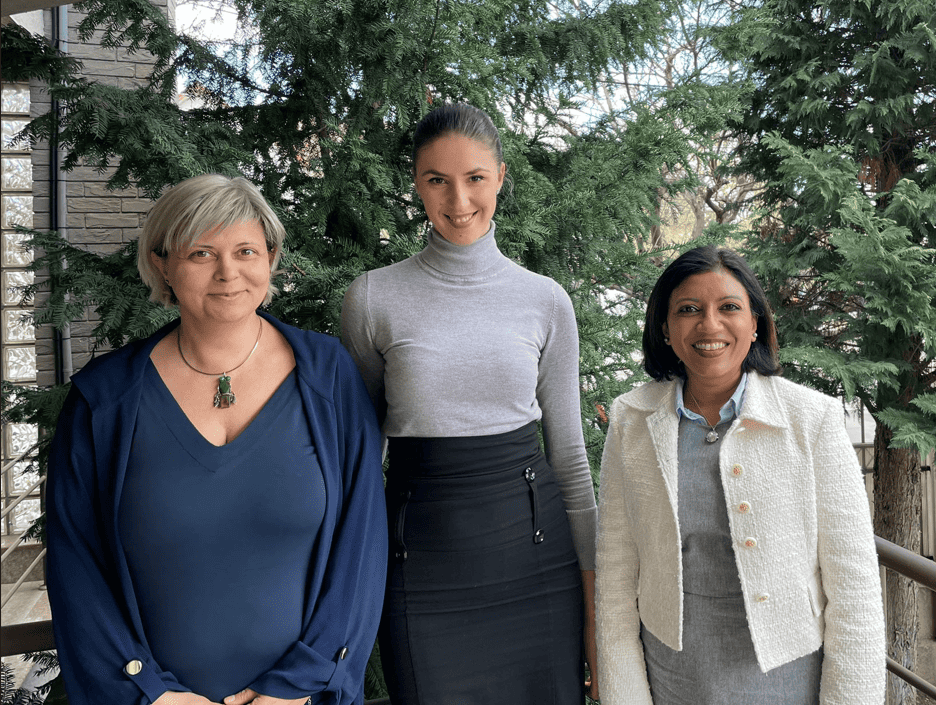

AGC Faktor was founded by London-based Advance Global Capital in partnership with Faktor Trust–a woman-led non-bank financial institution based in Macedonia. AGC brings funding, proprietary technology, and business development expertise to help the new factor establish a sustainable business. Faktor Trust provides regional industry expertise and relationships.

With this launch, AGC completes a regional network of financial providers who leverage our funding, technology, and expertise to grow their book of business in Kosovo, Macedonia, and Albania.

What’s Good for the Quail is Good for the Egg

“With the more immediate cash flow, we expect to hire more help and invest in our products,” said Mrs. Ahmeti. Her innovative food processing business will be able to leverage immediate payment to grow the business and meet increasing demand.

Bringing the first factor to Kosovo, AGC delivers a much-needed source of finance and development support to SMEs, while linking investors to an emerging market opportunity with a reasonable risk-adjusted return. Funding businesses like Miniferma Fëllënza will sow seeds of hope to bloom into opportunities for all.

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10