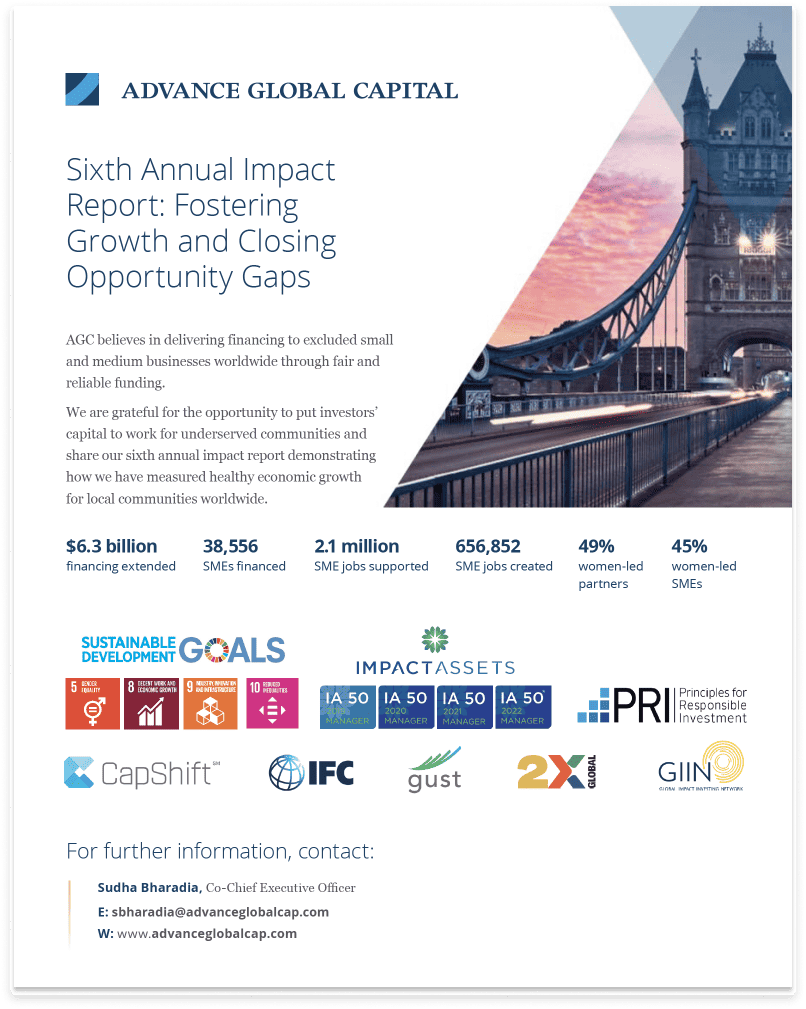

Putting capital to work

Working with local financing partners, we provide fair access to capital for small businesses in underserved communities worldwide so they have the credit they need to build their business.

Global Impact Investing

for SMEs

Financeable Assets

and Responsibly

A thoughtful approach to financial inclusion

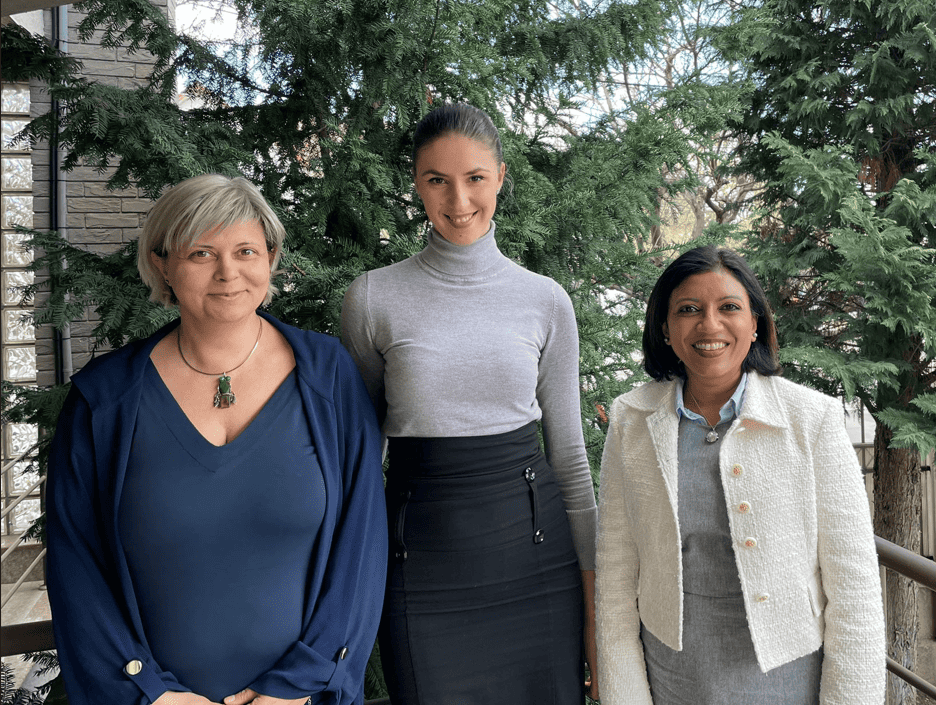

We specialize in providing financial solutions tailored to the needs of SMEs in underserved markets. Our experience lies in receivables financing, a powerful tool that unlocks the value of receivables as financeable assets. We are committed to supporting businesses owned by women and other underrepresented groups by Working closely with local non-bank financial institutions (“NBFIs”).

Put your principal to work as flexible capital for SMEs in undeserved markets.

Learn more about Advance Global Capital Funds

Responsible social impact

We work with financing partners and their SME clients to foster resilience in local financial ecosystems through alignment with industry regulation and standards. By adhering to recognized best practices, we strive to make a meaningful and lasting difference, empowering communities, and creating a more equitable and sustainable future responsibly.

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10

Making a difference

1 Data source : AGC and financing partners’ activity since inception (cumulative).

Data source: AGC estimate based on latest impact survey multiplied by number of entities as of the time period noted. Please see Chapter 3 – Methodology for full details.

Data source: AGC estimate based on latest impact survey multiplied by number of entities as of the time period noted. Please see Chapter 3 – Methodology for full details..

Data reflects outcomes reported in 2022 unless otherwise noted.