Trade receivables financing is the fastest growing form of trade finance with a current market value of US$ 2.8 trillion (Factor Chain International 2012), and growth will come from emerging markets.

Trade receivables financing is the fastest growing form of trade finance with a current market value of US$ 2.8 trillion (Factor Chain International 2012), and growth will come from emerging markets.

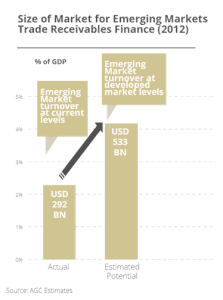

Factoring and invoice discounting volumes in emerging markets have a long way to go to reach developed markets’ levels of adoption. AGC estimates that if factoring in emerging markets were to rise to the global average of 4.2% of GDP, market turnover in emerging markets, excluding China, could be expected to increase from US$ 292 billion in 2012 to just over US$ 533 billion.

In particular, SMEs in emerging markets are often unaware that trade receivables financing exists and local financial institutions may not have the capabilities to offer it. AGC addresses this need by providing receivables financing for SMEs in Brazil, Kosovo, Slovenia, Peru, Macedonia and Singapore. Opportunities are being reviewed in Kenya, South Africa, Turkey, Kazakhstan and Croatia.