Supporting Decent Work and Economic Growth for Women in Malaysia

At first glance, Malaysia does not seem to be a great place for a woman to work or start a company. It ranks 104 of 144 in the latest Global Gender Gap study1 and women‐led companies face a $4.9bn gap in financing according to the IFC.2 However, the government has many initiatives to support small businesses – from government procurement policies to efforts to promote alternative sources of funding. But there is much to be done. With this reality in mind, our woman‐led financial partner provides private capital to help close the gap and create better opportunities for women in Malaysia.

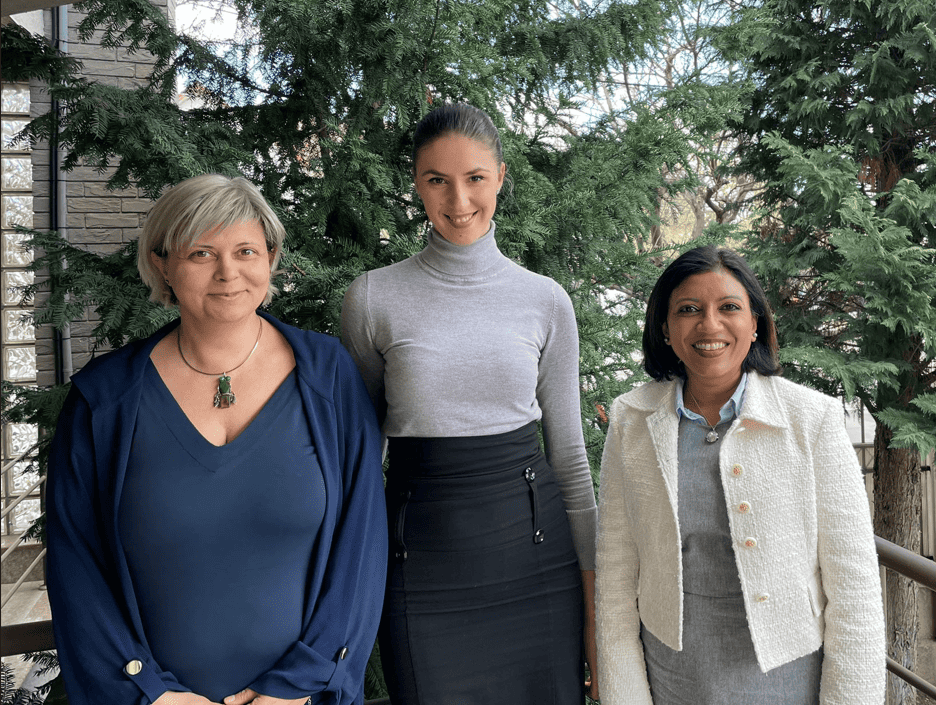

According to Nadia, COO and co‐owner of our partner in Malaysia, “We founded our financing company to support small businesses that are otherwise crushed by long payment terms from customers, and banks who are unwilling to lend to them on acceptable terms. The local banks that have provided us lines of credit sometimes scale back their lending, which suppresses our potential. As a result, we considered scaling back our growth plan. Thanks to financial support through AGC, we now anticipate growing our SME client base from 450 to 1000 clients this year.”

Supporting Small Businesses and Working Mothers

A crucial pillar of the Malaysian economy, SMEs represent 98.5 percent of total business establishments and are expected to contribute up to 41 percent to its GDP by 2020. However, they are underserved by local banking institutions. One of Nadia’s clients, ADI Enterprises, experiences the challenges of growing a business while supporting its staff. Ahmad Dali bin Mukeri established ADI Enterprises in 2000 as a service provider for local government entities, with a focus on building maintenance, landscaping and housekeeping. He employs five full‐time and 25 part‐time staff, 45 percent of whom are women. The Malaysian government has a mandate to source services from smaller suppliers like ADI, making the government a reliable customer, but it typically remits payment with a 60‐day delay. This significantly constrains Ahmad’s working capital and ability to make payroll. Like most service businesses, ADI has limited collateral, leaving ADI ineligible for a traditional bank loan. Typically, his only other option would be a much higher risk – funding from an often dangerous “loan shark”.

Flexible working capital allows Ahmad to pay his staff on time, helping approximately 30 families. And ensuring a more consistent cash flow has allowed him to invest in staff training and more predictable bonuses, all resulting in increased positivity and efficiency. According to Ahmad, “The help that we get from using the factoring facilities has improved our financial standing which brings us stability in our cash flow. This leads to better benefits for our employees, especially the women.” He adds, “Happy workers, happy business, happy life.”

1 World Economic Forum Global Gender Gap 2017. Malaysia Report. https://www.weforum.org/reports/the-global-gender-gap-report-2017

2 MSME Financing Gap, International Finance Corporation, 2017 https://www.smefinanceforum.org/data‐sites/msme‐finance‐gap

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10