AGC Expands Supply Chain Finance: Peru Case Study

Advanced Global Capital (AGC) continues to expand its global presence and recently broadened its activity in South America by providing supply chain finance to small and medium-sized enterprises (SMEs) in Peru. The investment was finalized in Fall 2014 and actively targets SMEs in the agriculture, shipping and textile sectors.

From Small Farms to Global Tables

One such initiative provides supply chain financing to suppliers of the Danish-Peruvian company Danper, which exports fresh and preserved asparagus, artichokes, peppers, string beans and fruit to markets around the world. Danper buys produce from a large number of these farmers who use part or all of their land to grow asparagus. After harvest, the farmers travel by bus to deliver the asparagus to Danper depots, where it is exported to countries in North America, Europe, Asia and South America through a network of distributors. Some of the funds invested by AGC are currently being distributed to local farmers who act as suppliers to Danper.

Strengthening the Supply Chain

AGC will continue to invest in financing this informal supply chain. The farmers often operate on a very small scale and are not formally registered with the government. As a result they are traditionally given written receipts and receive payment in two to three weeks. Using the capabilities of our partners in Peru, the farmers will be able to receive their money on the same day that they deliver the produce, reducing travel time, increasing efficiency, and providing immediate benefits to the families and their communities.

The deal allows AGC to increase the geographic diversification of its investments and work with a range of new partners in different sectors while also deepening its expertise in supply chain finance for agricultural suppliers. Additional funding for the program is provided by the Danish Investment Fund for Developing Countries.

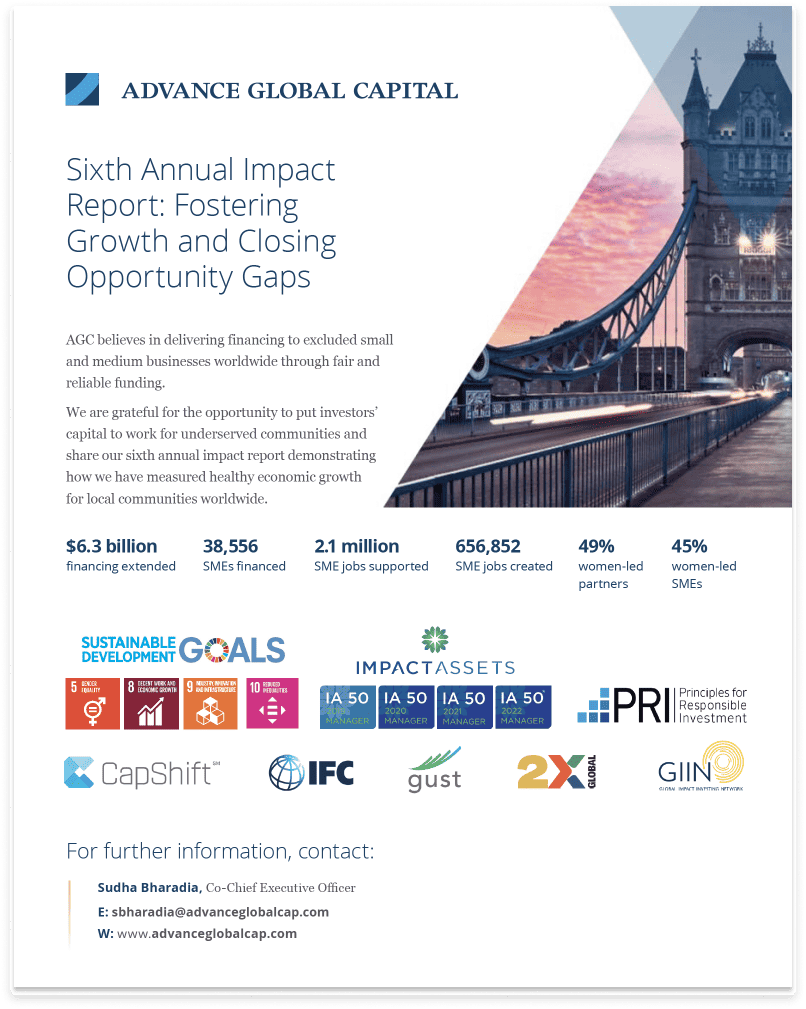

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10