Supply Chain Finance Partnership: Mexico Case Study

Inmagusa is a leading producer of heat-treated and non heat-treated frame rails and structural components for OEM manufacturers and a key supplier of transmission poles for electricity in North America. The company exports its products to eleven assembly plants throughout the USA, Canada and Mexico.

Advance Global Capital (AGC) helped to finance a joint initiative between Navistar, a leading US manufacturer of commercial vehicles, and Inmagusa, their supplier of metal components in Mexico. The facility was done in partnership with Prime Revenue, a global provider of Supply Chain Finance solutions and leading organization in optimizing and unlocking cash flow for corporations and their suppliers.

“As more leading organizations adopt Supply Chain Finance, there is a growing interest in inviting non-bank funders to existing and new financing programs in order to provide the required liquidity for corporations and their suppliers. We are excited to have Advance Global Capital as part of the funding pool and look forward to a successful partnership,” said Dan Juliano, Senior Vice President Business Development and Partnerships, PrimeRevenue.

“Our investment allows Inmagusa to receive payment of its invoices up front, freeing up its cash flow to purchase raw materials and pay employees,” said the Portfolio Manager at AGC. “Based on our ongoing success of the Inmagusa-Navistar financing, discussions have already begun to expand the pilot to additional suppliers across the globe,” added Admir Imami, CEO of Advance Global Capital.

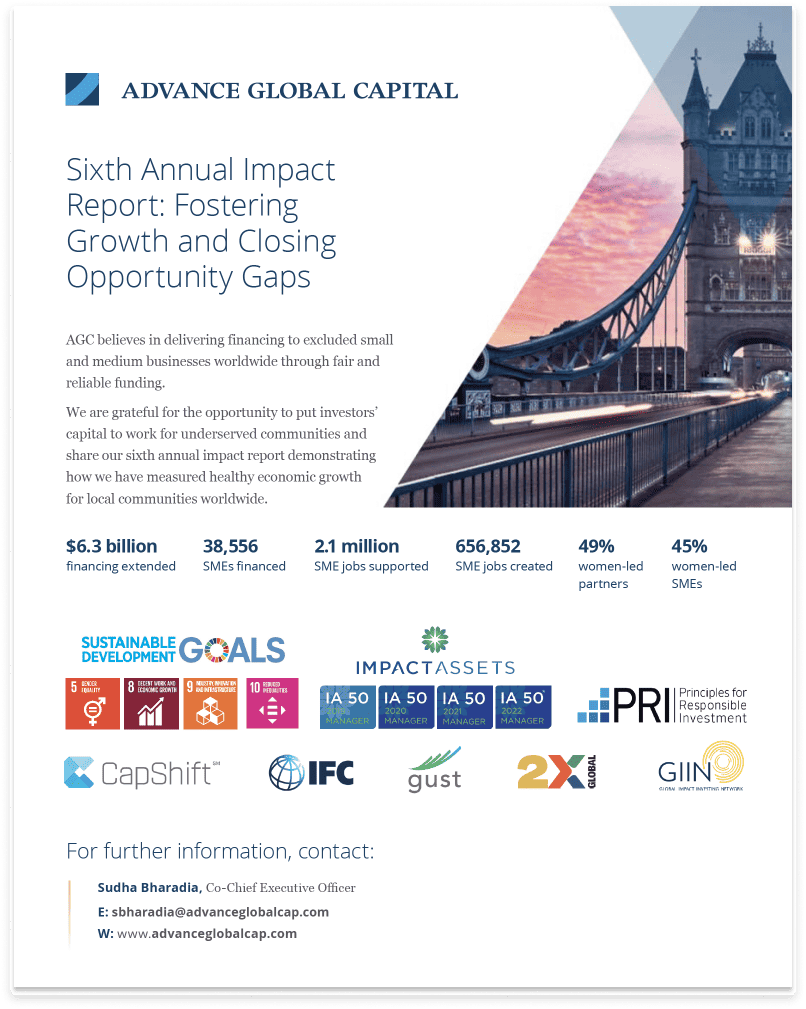

Advance Global Capital is happy to celebrate one year of investing in trade receivables from small and medium-sized enterprises (SMEs) in developing markets. These investments have delivered attractive financial returns and made positive social and economic impacts across the globe. We are grateful to our early investors who have given us the chance to participate in this exciting and growing industry.

Our investment allows Inmagusa to receive payment of its invoices up front, freeing up its cash flow to purchase raw materials and pay employees.

Advance Global Capital is happy to celebrate one year of investing in trade receivables from small and medium-sized enterprises (SMEs) in developing markets. These investments have delivered attractive financial returns and made positive social and economic impacts across the globe. We are grateful to our early investors who have given us the chance to participate in this exciting and growing industry.

Our diverse customer channels give us the flexibility to rapidly adjust our portfolio and take advantage of opportunities in a variety of sectors and geographic regions. To maximize our social impact, we are building our primary financing capabilities through relationships with non-bank financial institutions in Latin America, Africa, Asia and Eastern Europe. We are working with them to provide the right mix of funding and product expertise to efficiently originate transactions while maximizing returns for investors and local partners and strengthening the supply chains of local businesses. According to the Portfolio Manager at AGC, “The operating structure and IT offering provided to SMEs has allowed us to make ground-breaking inroads into countries where the availability of working capital finance has traditionally been quite limited.”

We have funded receivables in a range of industries including textiles (e.g. Hugo Boss supplier) and automotive manufacturing (e.g. Mexican rail frame supplier to Navistar). To meet our goal of maximizing our social impact, our core industry concentration is in small scale farming and food processors who sell to larger companies. Some of our successes include increased access to working capital for farmers of fresh agricultural produce, canned and frozen food processors as well as packaging companies who supply supermarkets both domestically and internationally.

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10