On a recent panel at The Hague discussing family office approaches to impact investment, Janet McKinley, Advance Global Capital (AGC) co-founder, was asked, “How do you address investors’ concerns about taking unconventional risk in impact investments they aren’t familiar with?” Her response was a challenge met by applause from the conference’s participants: “What’s so comforting about conventional risk? It brought about the biggest financial markets meltdown since 1929!”

On a recent panel at The Hague discussing family office approaches to impact investment, Janet McKinley, Advance Global Capital (AGC) co-founder, was asked, “How do you address investors’ concerns about taking unconventional risk in impact investments they aren’t familiar with?” Her response was a challenge met by applause from the conference’s participants: “What’s so comforting about conventional risk? It brought about the biggest financial markets meltdown since 1929!”

Managing Risk by Reducing Volatility

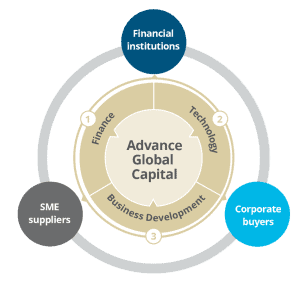

Big money, moving in and out of markets triggered by macro events, such as anticipated changes in central bank policy, can lead to big swings in publicly-traded securities. Thanks to high speed trading, it can happen in a matter of seconds. Momentum is an investor’s friend in a rising market, but not when it turns. AGC has chosen to build a portfolio of assets in emerging markets which are not so sensitive to market volatility— discounted invoices.

Confirmed invoices have an established price upfront and months later when the customer pays the invoice. The rate of return is not tied to any public market rate, such as LIBOR. The return on privately purchasing confirmed invoices from small to medium-sized enterprises (SMEs) in emerging markets reflects the opportunity that ready cash makes possible.

Why Industry Default Rates Are Low

“Product selection is your best risk reduction strategy,” according to Mark Chamings, chief risk officer with AGC. “A rigorous credit approval process, know-your-customer policies, on-going monitoring and the possibility of verification of the entire underlying transaction all contribute to low default rates observed in this asset class.”

According to a study by Factors Chain International, the default rates experienced on discounted invoices through the Great Recession of 2008-2009 rose slightly from .13% to .34% and quickly recovered to just .04% in 2010. (See AGC white paper: Receivables Finance in Emerging Markets.)

With financial transactions so closely tied to actual commerce, everyone’s reputation is on the line—a concept that seems to be less and less prevalent in today’s complex securities markets. When financing supply chains, the investor in invoices evaluates payment risk based on the reliability of the buyer. The buyer confirms invoices generated by a diverse combination of goods and services delivered by its suppliers.

With financial transactions so closely tied to actual commerce, everyone’s reputation is on the line—a concept that seems to be less and less prevalent in today’s complex securities markets. When financing supply chains, the investor in invoices evaluates payment risk based on the reliability of the buyer. The buyer confirms invoices generated by a diverse combination of goods and services delivered by its suppliers.

Buyers are highly motivated to pay invoices in full and on time because their ability to do business depends on their reputation. Suppliers have the flexibility to use invoice discounting when they need ready cash to grow their business. In the event of failure to pay, there is an enforceable recovery process in most jurisdictions around the world, founded on English or U.S. law.

How Small Gets Big

When putting money at risk, there is no such thing as a “sure thing”. For centuries, careful financing of commerce backed by invoices for goods and services has proven to be an attractive, stable investment. And as a result, small but growing businesses have become big contributors to the stability and prosperity of communities around the world. AGC aims to put more capital to work more quickly by focusing on small and medium-sized businesses with a high potential for growth.