Regenerative Finance Fosters Hope for Mexico’s Berry Farmers

In the third year of a global pandemic, now confronted by the challenges precipitated by the Russian invasion of Ukraine, it seems there’s nothing in the news but stories of catastrophe and suffering. However, in the spirit of spring — a season of hope and new possibilities — we’d like to highlight how private capital makes a difference and enables communities to stabilize and flourish.1

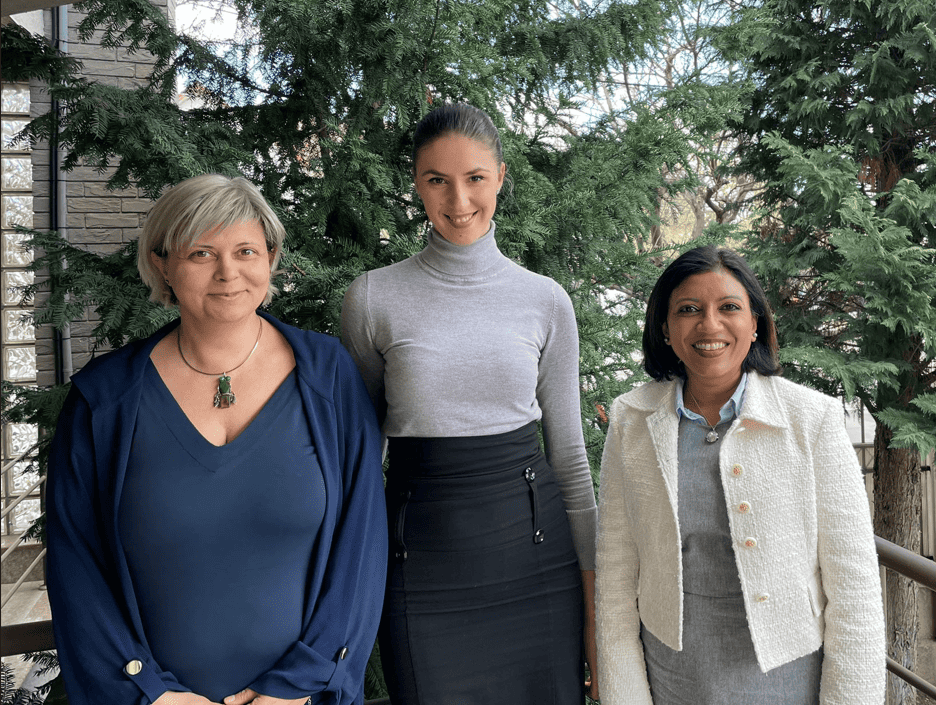

One of AGC’s partners in Mexico has deep expertise in the agricultural sector, and is helping us with our in-depth study on the impact of COVID-19 on financing small businesses in the sector in Mexico. Janette, Finance Director at AGC’s partner, explained, “In Mexico, companies didn’t receive subsidies from the government. Small businesses really struggled to make it to the next day.” Janette’s observations are supported by the research conducted by the World Bank and Mexican Government. In April 2020, 7.8% of businesses received support of some kind from the government or other institutions. By February 2021, this number dropped to 3.8%.2 As in other parts of the world, the banking sector was not very helpful at supporting small and medium businesses. Jannette notes, “During the pandemic, banks really restricted funding. Even clients with approved lines of credit couldn’t access bank financing.”

Additionally, they increased their exposure to agriculture and transportation for both business and ethical reasons. As Janette points out, “Everyone has to eat.” She and her team have built strong relationships with clients and industry associations over time, so they continue to receive strong client referrals and collaborate through uncertain times. This strategy has paid off. Janette believes that her company has now reached stability.

She notes, “Most of our clients survived and 98% of the clients that had needed adjusted payment terms are back to normal.” Last year, she was able to grow the business by 30% and expects it to increase another 35% this year, adding about 700 million Pesos ($42 million) in revenue. The company has also been able to create jobs. In 2021, they added five full-time team members and expect to add five more in 2022. Janette explains, “Even though the pandemic is still here in Mexico, we are finding success in our company.”

Janette finds the best, most consistent clients through referrals, including those from agricultural co-ops and associations. She notes, “One of our most popular products is funding farmers who sell berries to the agricultural associations, who then package and ship the fruit to clients outside of Mexico.” After a challenging past couple of years, clients are starting to rebuild and grow. Janette adds that she knows that their efforts are making a difference. With support from our investors, and our partners, AGC hopes to contribute to solid economic growth that benefits more people — especially in times of crisis.

May the economy be concrete, not ‘liquid’ or ‘gaseous’, as is the danger with finance.

– Pope Francis I, in prepared remarks at the Vatican, March 14, 2022.

SME quotes | How financing helps

“It helped me obtain more equipment, machinery and fertilizer for higher production.”

“Allowed us to increase inventory levels to support expansion in the market.”

“Speedy and timely cash flow.”

“It helped me to expand and acquire new equipmen and tools for the field.”

“It helped us grow 2 hectares of raspberries and meet payroll expenses.”

1 The content for this story is an excerpt from a research project AGC is conducting with University of California Berkeley’s Master of Development Program candidate, Power Mukisa, a student from Uganda. The research will focus on the impact of COVID-19 on financing small businesses in the agricultural sector in Mexico and will be published later in the year. As part of its field building activities, AGC is a regular speaker at the innovative finance module and collaborates from with promising students on topics of mutual interest.

2 Survey on the Economic Impact Generated by COVID-19 on Enterprises (ECOVID-IE). The National Institute of Statistics and Geography (INEGI), an autonomous agency of the Mexican Government with participation with support of the World Bank conducted surveys in April and August 2020 as well as February 2021 covering 1,873,564 companies to assess the effects of the pandemic on their business. https://en.www.inegi.org.mx/programas/ecovidie/

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10