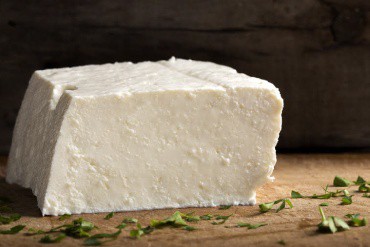

Fast, Flexible Working Capital Delivers High-Quality Telemea Cheese to Dinner Tables

Specialty products meet specialty strategies

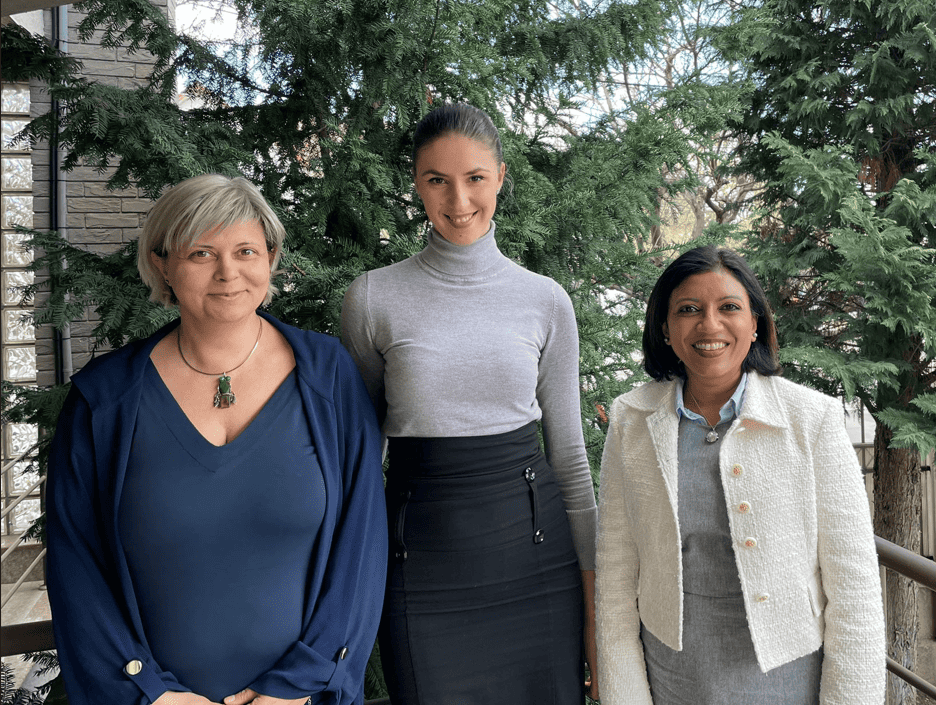

Established in 1998, it wasn’t until 2013 that Romania-based Porter Solutions found a winning strategy: working with local cheese producers to deliver high-quality Telemea, a traditional variety of Romanian cheese similar to feta, through Carrefour’s nationwide network of grocery stores. Leveraging his 25 years’ experience working with multinationals and local businesses, Catalin Lungu, founder and CEO of Porter Solutions explains, “I started a relationship with Carrefour, and was able to establish myself as a valuable partner. I identified suitable small cheese producers, and worked with them to satisfy Carrefour’s specific packaging and quality standards.”

Now employing 10 people, two of whom are women, Porter Solutions’ oldest suppliers consist of small family-run farms spread across the rolling hills of surrounding regions, and who value customer relationships, reputation, and a loyalty to the age-old methods of cheese-making. “Often people think of them as companies with a grandmother using her traditional skills to make delicious Telemea from fresh milk.”

Specialists in the field, Porter Solutions sources a wide range of distinct regional varieties of Telemea—from the northern mountainous region of Maremureș to the southern plains in the Bărăgan region—and not only knows what consumers want, but is able to advise cheese producers first-hand. As further testament to their lasting connections and credible products, they consult with the cheese suppliers on tactics for improving and responding to customer tastes. “We help them squeeze everything possible out of their cheese,” states Mr. Lungu, “Our advice and support keeps them wanting to work with us.”

A unique supply chain lacks needed liquidity

When Mr. Lungu first established Porter Solutions, his biggest challenge was securing working capital. “Even if we combined all of our resources—including everything within our pockets—to start the business, we couldn’t find enough financial resources to continue.” He continues, “When we first heard about the idea of factoring, it seemed like the most efficient solution.”

In Mr. Lungu’s line of business, the supply chain is very short. Typically, Porter Solutions buys cheese from small producers, who buy milk from famers. In some isolated areas, such as Maramureș, the dairy farmer might also produce the cheese. While small cheese producers were looking to Porter Solutions to get their cheese into new markets, the money wasn’t coming fast enough. Porter Solutions was struggling to cover all needs throughout the distribution chain. Mr. Lungu explains “Theoretically, my customers should pay in 30 days, but in practice the money arrives after 45 days. We try and pay our suppliers between 15 and 30 days, because otherwise they can’t support their suppliers—the farmers. At times like Christmas and Easter holidays when sales increase a lot, we urgently need access to working capital finance.”

To further complicate funding issues, the arrival of 2020’s pandemic required Mr. Lungu to once again adjust business strategies. He states, “The pandemic cut us off from various sources of revenue, especially in the HoReCa (food service) industry. For example, normally we sell to famous restaurants in Bucharest but this segment stopped ordering altogether due to lockdown measures. If the pandemic hadn’t happened, I estimate we would have grown 30% compared to last year. This year, unfortunately, we will fight to reach the value of last year’s turnover.”

While Porter Solutions initially turned to a bank for their factoring needs, the process quickly became so cumbersome that they gave up. Fortunately for Mr. Lungu, and his various suppliers throughout the region, he found AGC’s partner—and things began to shift for the better.

Factoring has clearly helped us to grow our business, because working capital financing allows us to purchase the right quantities of goods from suppliers, and pay for them in such a way that we can maintain appropriate supply levels.

Fast, flexible solutions via working capital

Thanks to AGC’s partner, Porter Solutions now has the support and flexibility to receive payments from customers immediately. “Speed is critical,” explains Mr. Lungu. “That, combined with the flexibility we’ve received with AGC’s partner, has been a vital element of our relationship. For example, our experience with banks is that they needed significant time to increase credit lines, but with AGC’s partner, we got it without any delay.”

Porter Solutions has utilized both selective invoice factoring and whole book factoring, although more recently has favored selective invoice discounting during peak payment periods (times when payment is needed for suppliers, utilities, and obligatory payments to the government with a priority to social support payments).

“AGC’s partner offers quick response times, and is always available to discuss pretty much anything—which is important to me,” Mr. Lungu explains. “Factoring has clearly helped us to grow our business, because working capital financing allows us to purchase the right quantities of goods from suppliers, and pay for them in such a way that we can maintain appropriate supply levels.”

By providing steady cashflow, factoring ensures products can continue to move through supply chains, strengthening and supporting local communities.

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10