Evening the playing field financing truckers in the heart of Europe.

Zlaté české ručičky a chytré české hlavičky is an old adage meaning, “Golden Czech hands and clever Czech heads.” Located in the center of Central Europe, Czechia was known as the industrial heartland of the Austro-Hungarian Empire. Some famous Czech inventions that have survived Communist rule include Budweiser beer (Budějovický Budvar), soft contact lenses (kontaktní čočky), sugar cubes, and Škoda cars. One of AGC’s partners is helping to sustain small businesses — despite nearby military conflict and challenging economic times.

Specializing in financing for individual truck drivers, AGC’s partner provides funding to small and medium sized companies operating in supply chain and logistics industries. The father-son team took over and modernized an existing business with fintech solutions to improve products and services to their clients, and to optimize risk management. Using data analysis and automation, AGC’s partner offers instant risk modelling and, as the service is fully digitized, customers can receive payment of invoices within minutes. This contrasts with the three-month average for invoice payments or waiting for weeks in order to obtain traditional financing. Jaroslav, CEO of AGC’s partner noted that, “Most customers can get their invoices sorted with a few clicks — it’s difficult to overstate just how much peace of mind this provides. The world is in a challenging economic period. Inflation is rising, there are signs of recession and issues relating to the pandemic are still being felt. The increase in fuel costs due to the war in Ukraine has added to the burden that SMEs and independent haulers face. A lack of working capital, 90-day invoice maturities and often expensive or unattainable bank financing is something logistics companies in Europe really struggle with. Our belief is that by tackling financial exclusion and under-banking we can really make a difference in people’s lives by giving them the tools they need to grow their business on an even playing field.”

One of Jaroslav’s clients, Nord Speed, is a two-person trucking company located in the north of Czechia near the Polish and German borders. The company specializes in transporting goods for the automotive industry and recently won a long-term contract with Volkswagen. (Škoda Auto joined the Volkswagen Group in 1991.) The company is owned by Ladislav Hanuliak, who is responsible for mechanical and technical affairs and drives the truck. Blanka Voplakalová handles everything else. Before the conflict in Ukraine started earlier this year, the company had three trucks and drivers. They had to sell two of the trucks both because of a drop in trade with their eastern neighbors, but mostly because they couldn’t find qualified drivers. Blanka noted that, “Qualified Ukrainian drivers went home to fight the Russians.” The company has weathered other challenges in the past couple of years too. Blanka explained that, “During the COVID-19 pandemic, car production dropped due to the shortage of chips, so our business to the automotive industry declined. Conversely, online sales jumped, so our business transporting people’s online orders increased dramatically.”

In addition to diversifying their client base, Nord Speed has also increased activity with customers in the west, especially Germany. Blanka noted that, “The conflict in Ukraine has led to an increase in fuel prices. Everything is more expensive now. So that has been felt a lot. In the logistics industry, activity has really shifted away from Russia and Ukraine. We have reoriented our activities towards EU countries because it was simply just too risky to continue doing business within the two affected markets.”

I really enjoy being able to help businesses that are just starting as well as that are already established firms that just need to make sure that what they’re doing actually makes sense from a business perspective.

Beyond the risks of doing business with countries engaged in military conflict, another change Blanka has noticed is the lengthening of payment terms. With the notable exception of Germany who pays us early, “Customers from most countries are delaying payments to us. By law, the maximum days payable for invoices is 45 days. What we’re finding, however, is that, apart from Germany, customers are delaying payment by an additional 17 to 19 days. Our clients from Italy, Slovakia, Spain, and Poland are able to pay, but don’t pay on time. They just want to help their own cashflow position.”

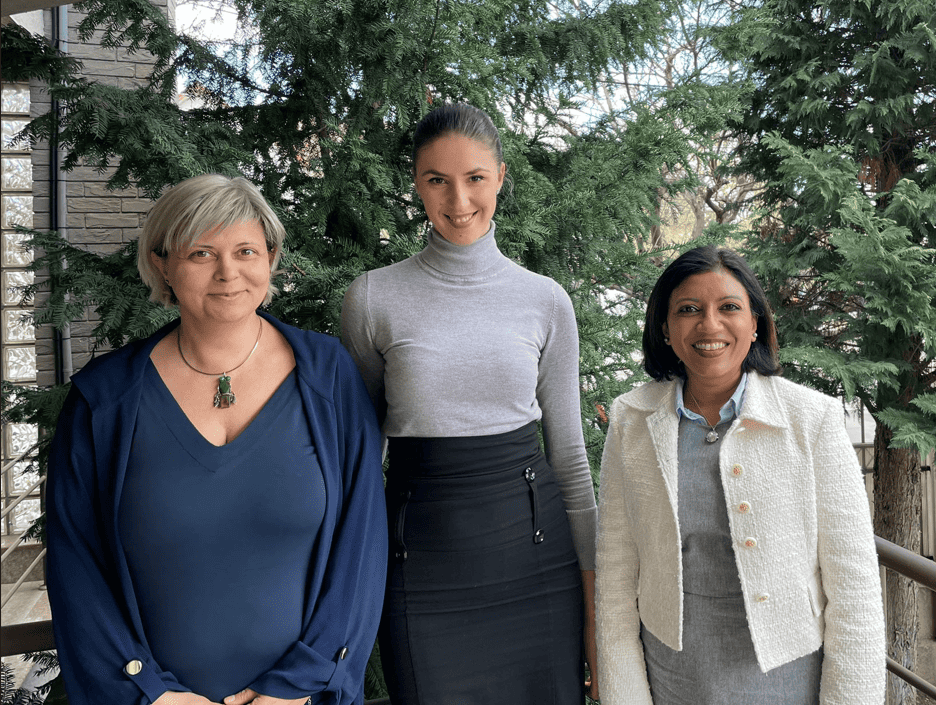

Nord Speed’s truck, and Blanka at Nord Speed’s headquarters in Jablonec nad Nisou, Czechia[/caption]Nord Speed discounts about half of the invoices from around 100 clients with AGC’s partner. Blanka appreciates not only the quick service but also the fact she can see her clients’ scoring and can track when they pay her in real-time. The credit insurance offering is also useful. “As a small business, it would be incredibly hard and expensive to access this on our own. We also appreciate the legal advice we receive on how to format our CMR documentation.” (CMR is a legal document certifying that goods have moved from point A to point B.) Just as AGC’s partner is helping Nord Speed thrive, Blanka is also helping to pay it forward. She is a qualified advisor and administers a Facebook group for young truck drivers, helping them to establish their own trucking companies and find new clients. She says, “I really enjoy being able to help businesses that are just starting as well as that are already established firms that just need to make sure that what they’re doing actually makes sense from a business perspective.”

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10