Broadening and expanding offerings in the Baltic region, a journey with Finora.

“It took us close to two years but yes indeed, last spring we got the principal decision from the European Central Bank to issue us a banking license.” shared Andrus Alber, CEO of Finora Group, AGC’s financing partner based in Tallinn Estonia. In a truly exceptional case, Finora was the only entity to receive a banking license in the Baltic region last year. Since 2014, Finora has been consistent with their growth, offerings, and expansion within the financial institution landscape in Estonia and Lithuania. After partnering with AGC, expansion of their business operations continued to help them accelerate their strategy eventually leading to their “graduation” from AGC this spring. Finora Bank began collecting deposits by the end of December 2022, adding further offerings to their portfolio to meet the needs and growing demand from clients and customers.

When Finora initially launched in 2014, their offerings mainly focused on mortgage-backed loans. It wasn’t long before customer demand meant that Finora had to prioritize additional focus toward factoring which then also led them to evolve onto further offerings such as leasing, working capital loans and guarantees. Andrus notes, “We have been extending our product offering based on what customers have asked us, so by the end of 2018 we had as broad an offering to SMEs as any bank.” Finora had a mutually beneficial relationship with AGC that enabled them to expand their operations by outgrowing the partnership and seeking alternative means of raising capital. They value AGC’s position in the market because smaller lenders are constantly struggling to get funding from large banking institutions to support small businesses. Banks in their region are typically not supportive and as a result, AGC presents a reliable avenue as the way that non-bank lenders can get funding and continue the chain of impact to help SMEs.

One of AGC’s impact objectives is to strengthen local financial ecosystems and we have achieved this through our relationship with Finora since it began in 2018. Since that time, AGC has helped Finora provide finance to SMEs in the form of a factoring product resulting in clients acknowledging them for their cooperation, flexibility and attitude which has set them apart from other financiers. Noting that it is not simple to find funding, AGC helped Finora grow their portfolio over time to help them help SMEs and become a bank.

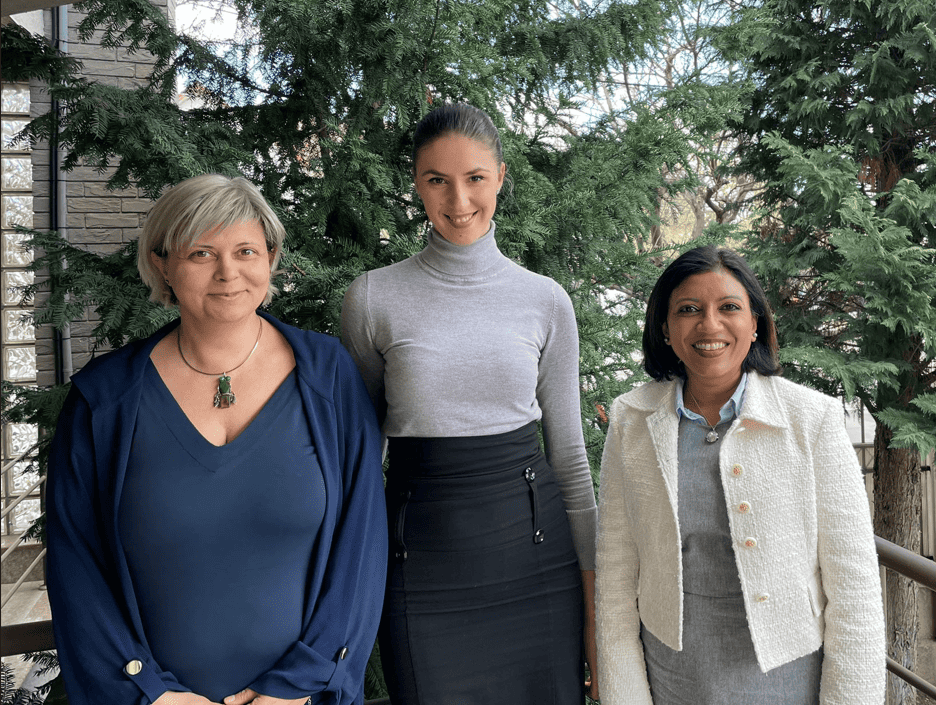

In addition to their breadth of products, Finora also has a condensed and decisive application process for SMEs which contrasts with that of lengthier processes undertaken by most banks due to their reluctance to support smaller businesses with capital in the Baltic region1. Finora goes on to explain their belief system behind supporting customers facing these challenges sharing, “Usually big banks are offering you the umbrella when the sun is shining, Finora does their best to offer our clients the umbrella when the rain is falling down”, Cäty Õunloo, Business Client Relationships Manager at Finora shares. Cäty is a part of the two-thirds of women employed with Finora where they have played a role in being able to support clients. “We are very proud that 90% of our existing customers are ready to recommend us to their friends and partners. And many have done it in real life, not just in words,” adds Cäty.

It took us close to two years but yes indeed, last spring we got the principal decision from the European Central Bank to issue us a banking license.

– Andrus Alber, CEO of Finora Group

When it comes to their lending process and customer service, Finora stands out to prospective clients with their decisive, personable, and transparent conditions as part and parcel of their lending process. Andrus shares, “I guess the reason they’re turning to us is because we are treating our customers fairer, we don’t charge them any contract, sign up or limit change fees.” Before taking on a client from the factoring side, because there is a two-party seller and borrower who pays invoices, Finora evaluates the borrower as they are waiting to receive money back from them. They also evaluate how long the applying client has been operating, their general and financial background as well as any history of problems or available public financial information. The process initially begins as an email exchange however, to further evaluate their main criteria before taking on an SME, Finora prefers conducting a phone call with customers to better understand the what the client is looking for and to establish a better connection with them.

By the end of 2014, Finora had 30 customers when offering only mortgage-backed loans. They estimate that they are now supporting around 500 clients. Analysis on data conducted by the OECD library cites key developments on SME financing and entrepreneurship in Estonia by highlighting the importance of SMEs to the Estonian economy. Just 0.2% of Estonian businesses in 2019 had more than 250 employees. SME exports made up 84% of all goods and services, employed 79% of the private sector’s employees, and contributed 79.5% to the economy’s value-added score, and 17% of SMEs exported their products. Micro-enterprises, or businesses with fewer than 10 employees, made up as much as 92% of all businesses in 2019, employing 33% of the labour force and contributing 29.2% of the total value produced.2 With SMEs making up a substantial percentage of the working economy in Estonia, Finora’s ambitions to become a bank were timely given how the workforce is mainly comprised and represented by small businesses.

Last fall, Finora marked the end of a robust journey full of key milestones central to their accomplishment in becoming a bank. Since September they have been operating as a bank in Lithuania and at the start of January, continued with expansion of their operations in Estonia. Finora’s client industries and sectors range from construction, transportation, and retail. When operating as a non-bank lender, many growing financial institutions face challenges such as limitations on how financing can be used as well as the amount invested into their institution and significant costs of funding thus impacting the capacity at which they can operate or support clients. Applying for a banking license helped Finora make their departure from these limitations and enabled them to pivot focus on furthering new strategies to attract additional financing and activate growth for the bank portfolio. “We decided a few years ago that we will go and apply for a banking license. It’s a lengthy and burdensome exercise. I think we submitted probably 2,500 pages of various documents.” Andrus shares.

Now that they’re a bank, Finora has focused their strategy on how they will attract customers on the deposit side. Looking ahead, Finora Bank has plans in 2023 focused on their core markets in Lithuania and Estonia. They are also looking to expand product offerings to consumers as 97% percent of their current loan book is with companies. In five to seven years, they hope to do an IPO and be listed on the local stock exchange.

Alignment to Global Sustainability Standards

We are closely aligned with United Nations Sustainability Goals 5, 8, 9 and 10