London, 14 March 2023 – Advance Global Capital Ltd is delighted to announce that its flagship fund has been selected for the ImpactAssets 50 (IA 50) list for the fifth year running. The list is the first publicly available database that provides a gateway into the world of impact investing for investors and their financial advisors, offering an easy way to identify experienced impact investment firms and explore the landscape of potential investment options. Applications are reviewed by a Review Committee of veteran Impact Investors.

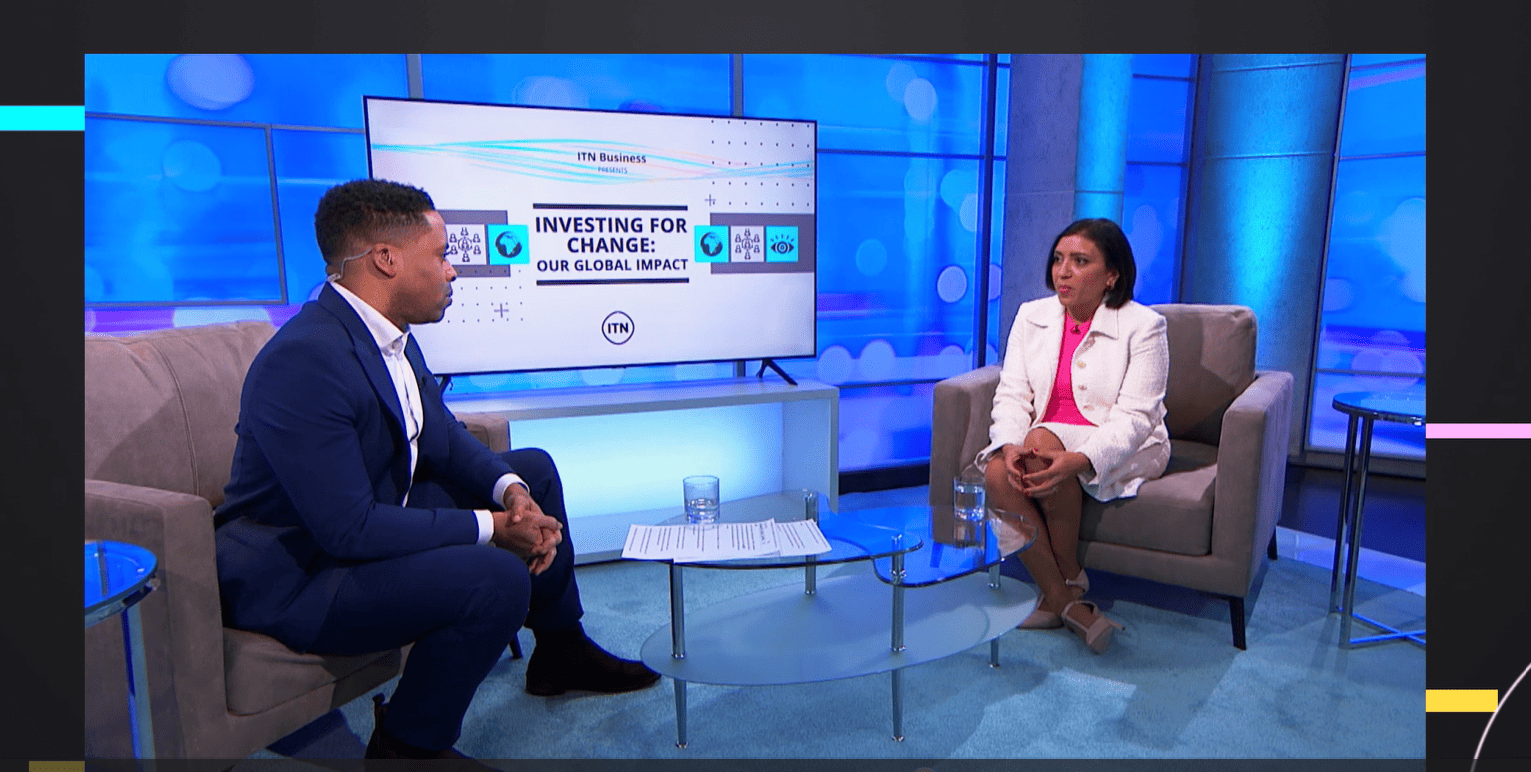

Sudha Bharadia, Co-CEO of Advance Global Capital Ltd, said: “The last few years have been difficult for many people all over the world for many different reasons. When we launched Advance Global Capital Ltd some years ago, one of our goals was to avoid the “casino” culture that stock markets feed on. To this day, and as our track record demonstrates, our mission remains solid — to provide responsible working capital to SMEs all over the world who need it to thrive and survive. It truly is an honor to be recognised by Impact Assets 50 for the fifth year running”.

In its twelfth year, the IA 50 continues to raise awareness of impact fund managers across impact areas, maturity, and geography, serving as a basis for deepening understanding of the field. Across all three categories, 163 impact fund managers reported assets totaling $122.48 billion invested in a range of asset classes and impact themes, demonstrating the strength, diversity and scale that impact investing has achieved.

“This year’s IA 50 showcase is a watershed, as the industry continues to allocate more investable assets into social and environmental solutions with both time-tested strategies and creative, new approaches. Established funds continue to impress, while new funds are bringing fresh approaches and insights that move the needle in critical areas through impact investing,” said Jed Emerson, ImpactAssets Senior Fellow, IA 50 Review Committee Chair and Chief Impact Officer at AlTi Global.

The database is compiled by ImpactAssets, a leading impact investing firm offering deep strategic expertise to help their clients define and execute their impact goals. Founded in 2010, ImpactAssets increases flows of money to impact investing through their impact investment platform and field-building initiatives, including the IA 50 database of private debt and equity impact fund managers. ImpactAssets has more than $2 billion in assets in 1,700 donor advised fund accounts, working with purpose-driven individuals and their wealth managers, family offices, foundations, and corporations.

About Advance Global Capital

Advance Global Capital, a global impact investment management company, believes that private capital, when invested well, can be a force for good. Working with local financing partners, we provide fair access to capital for small businesses in underserved communities worldwide so they have the credit they need to build their business.

Sudha Bharadia, Co-CEO

sbharadia@advanceglobalcap.com

+44 (0) 7855 111 048