At the recent Global Entrepreneurship Summit in Kenya, President Obama called entrepreneurship “the spark of prosperity.” He said: “Entrepreneurship creates new jobs and new businesses, new ways to deliver basic services, new ways of seeing the world…It helps citizens stand up for their rights and push back against corruption.”

A healthy business climate generates both supply and demand, a push and pull in both directions: innovation meets demand and growing demand creates jobs and raises incomes; more economic activity increases salaries, profits, and benefits for all. For emerging markets to “emerge” they need both the push of innovation and the pull of rising demand. Too often, entrepreneurs choose to stay small because the cost of capital is too high or it is simply not available to them.

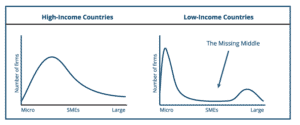

The Missing Middle

In developed countries, small- to medium-sized enterprises (SMEs) represent 50% of the GDP and 60% of employment. In developing countries, SMEs only account for 17% of GDP and 30% of employment. In developed countries, the economy is powered by a large number of SMEs and a healthy distribution of medium to large firms. Developing countries show a sharp spike in microenterprises and a slight bump in large firms with a lack SMEs in the middle to drive job creation and economic growth. (See The Missing Middle.)

To grow from a microenterprise or a startup to a bigger business requires access to capital. The International Finance Corporation (IFC) estimates that of the 25 million to 30 million SMEs in developing countries, 55% to 68% are unserved or underserved by financial services, generating a $1 trillion gap in credit financing.

To grow from a microenterprise or a startup to a bigger business requires access to capital. The International Finance Corporation (IFC) estimates that of the 25 million to 30 million SMEs in developing countries, 55% to 68% are unserved or underserved by financial services, generating a $1 trillion gap in credit financing.

Researchers at the Entrepreneurial Finance Lab at the Kennedy School of Government found that SMEs in these markets were profitable and able to generate high return, yet the majority of them do not have access to capital. “There is a massive profit opportunity for those who are able to successfully finance these firms,” according to the Entrepreneurial Finance Lab Research Initiative.

Nurturing Innovation and Entrepreneurship

In countries struggling with high unemployment and very low incomes, the microfinance movement has helped to reduce the vulnerability of poor women by enabling them to generate their own income and increase their savings. The number of microenterprises is high. But a successful microenterprise outgrows the microfinance market and has limited access to financing as an SME.

Local commercial banks have little incentive to serve the SME market by investing in technology to streamline credit evaluations, lowering the cost and risk of doing business with SMEs. These banks typically follow a low-risk strategy of bringing in deposits and investing in government bonds to earn the spread. Their lending is collateralized and relationship-based, targeting high end customers with a reliable track record.

works with local financial institutions in emerging and underserved markets to bring appropriately structured financing to SMEs. Invoice discounting and supply chain finance enable SMEs to convert invoices into cash after they deliver goods and services to buyers. Instead of waiting 60 to 90 days for payment, they have immediate access to the working capital they need to hire employees, buy supplies, or expand production. AGC helps entrepreneurs choose growth without more collateralized debt on their balance sheets.

A Sustainable Financial Ecosystem

When AGC considered what role to play in building a stronger business climate, we recognized that the challenges in emerging markets required new ways of doing business: more sophisticated legal practices, stronger local financial institutions, broader use of technology, and more products promoting greater financial inclusion. Invoice discounting and supply chain finance enable local financial institutions to unlock new markets and bring working capital to SMEs, based on the credit-worthiness of their buyers.

As local financial institutions deliver access to capital that is flexible and predictable, both providers and customers develop a track record and generate lasting economic benefit. AGC believes that a wholistic approach to business development with access to capital and technology will generate both immediate return and lasting impact on the business climate and financial systems of emerging and underserved markets.